The change fee between Bitcoin (BTC), the world’s first and largest cryptocurrency by market capitalization, and Ether (ETH), the world’s second-largest cryptocurrency by market capitalization that powers the Ethereum blockchain, has fallen quickly in current weeks.

ETH/BTC was final altering fingers on Binance (as per TradingView) round 0.0625, down round 15% from earlier month-to-month highs within the 0.0735 space and at its lowest stage since July 2022.

ETH/BTC’s draw back isn’t a results of Ether performing poorly. Quite the opposite, at present ranges within the $1,750s, Ether is up simply shy of 10% this month and is up over 27% versus earlier month-to-month lows beneath $1,400.

The issue for Ether is that it, like most different cryptocurrencies, hasn’t been in a position to hold tempo with Bitcoin. Bitcoin has been main a cost increased in cryptocurrency markets amid what analysts have known as a “protected haven” bid as cracks kind within the international banking system.

Monetary Stability Issues Disproportionately Profit Bitcoin

After three major regional US banks went beneath earlier this month, Credit score Suisse was bought out by Swiss rival UBS over the weekend. In the meantime, a consortium of US banks got here collectively final week to offer a $30 billion bailout for US financial institution First Republic.

Regardless of efforts from authorities to calm the scenario, investors remain on edge that extra banks, within the US and elsewhere, could be about to go beneath. And whereas that is hampering sentiment in US inventory markets, it’s serving to protected haven property like gold, and in addition seems to be serving to cryptocurrencies like Bitcoin.

Gold fashioned the bedrock of most civilizations’ monetary programs for 1000’s of years, therefore when troubles within the fiat-based, central bank-centered fractional reserve banking system floor, many buyers wish to flock again to gold, which many view as the last word haven.

However Bitcoin, which many consult with as “digital gold”, is more and more seen as a protected haven. In any case, it’s a extremely sturdy, extremely decentralized cost system that operates solely individually from the standard monetary system.

Ether also can make the declare to be sturdy, decentralized, and impartial of the standard monetary system. Certainly, given its good programmability, it arguably goes past Bitcoin in that an impartial decentralized finance ecosystem may be constructed straight on high of its blockchain (and already is being constructed).

However Ether is just about half the age of Bitcoin. Within the eyes of many buyers, Bitcoin has extra belief, significantly provided that its future prospects don’t rely on the efforts of programmers (just like the Ethereum Basis who’re nonetheless working to improve the Ethereum blockchain). Bitcoin is anticipated to stay just about precisely how it’s proper now, roughly like gold.

Despite the fact that the Fed’s fee mountain climbing cycle won’t but be over (they might hike charges by 25 bps this week), markets are already putting bets on the reducing cycle, with many anticipating it to come back quickly amid turbulence within the banking sector. Easing monetary circumstances might properly assist elevate cryptocurrencies broadly (together with Ether), although Bitcoin is prone to preserve its lead on the added safe-haven bid.

On-chain Developments Favor Additional ETH/BTC Draw back

Simply as buyers more and more flip to Bitcoin as a safe haven, varied core on-chain exercise metrics are trending increased, exhibiting a rising demand for community utilization. On most of the identical metrics, the Ethereum blockchain is exhibiting no such pick-up in exercise.

Whereas this most likely gained’t outright stop Ether from persevering with to rally (not if the broader crypto market retains pumping), it could make it tough for ETH to maintain up with Bitcoin, that means potential additional draw back for the ETH/BTC change fee.

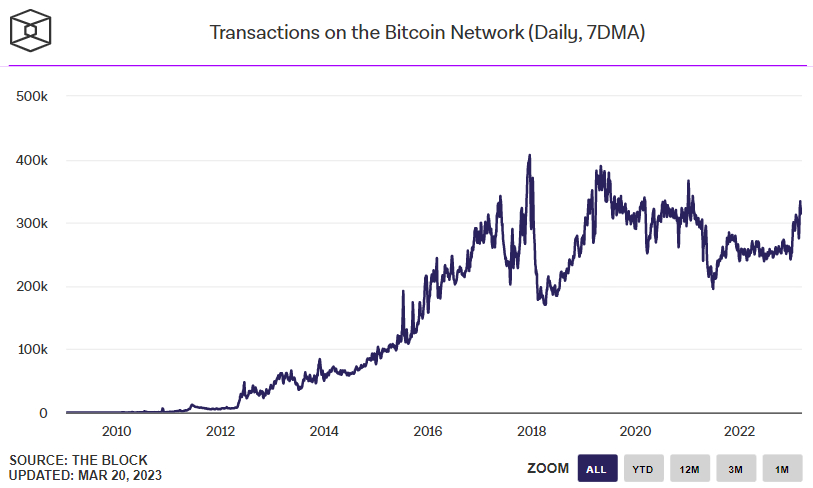

The primary metric of notice is the variety of transactions going down each day. As may be seen within the under graphs introduced by The Block, this metric just lately hit its highest stage since early 2021 for the Bitcoin community, however stays subdued and inside current ranges for the Ethereum community.

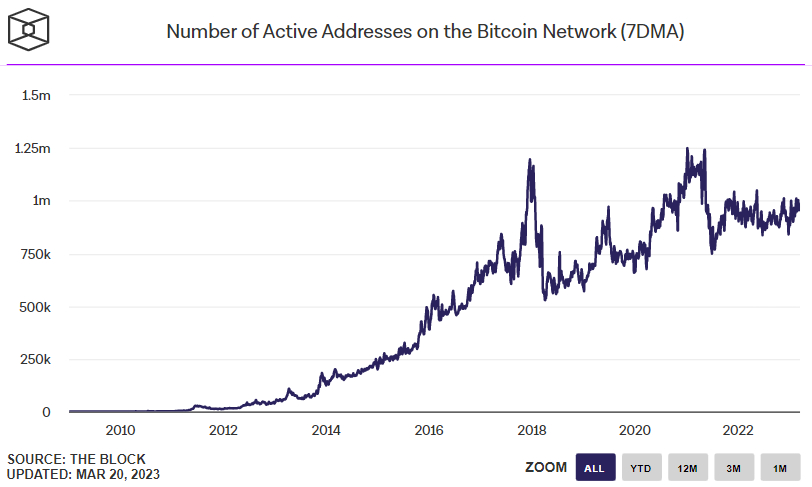

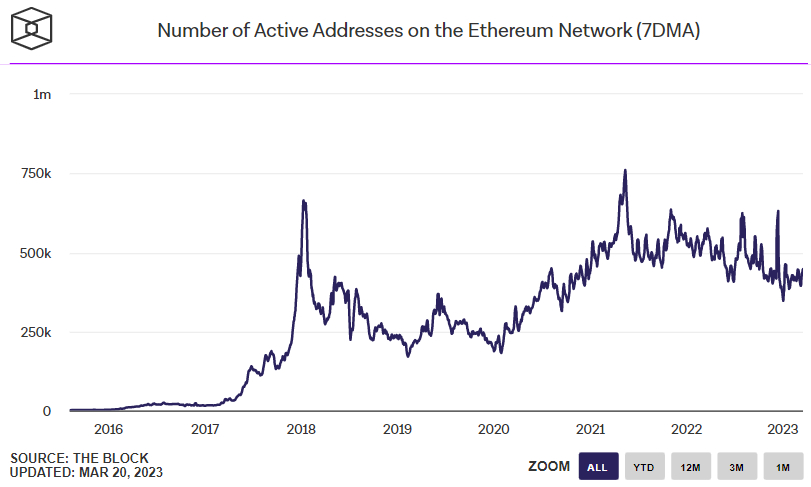

In the meantime, although the rise within the variety of lively addresses on the Bitcoin community in current weeks hasn’t been fairly as spectacular, the metric continues to be near multi-month highs. The identical can’t be stated for the variety of lively addresses on the Ethereum community.

Elsewhere, the speed at which new addresses are interacting with the Bitcoin community for the primary time has additionally been trending increased. The identical can’t be stated for the Ethereum community, with new addresses remaining near multi-year lows.